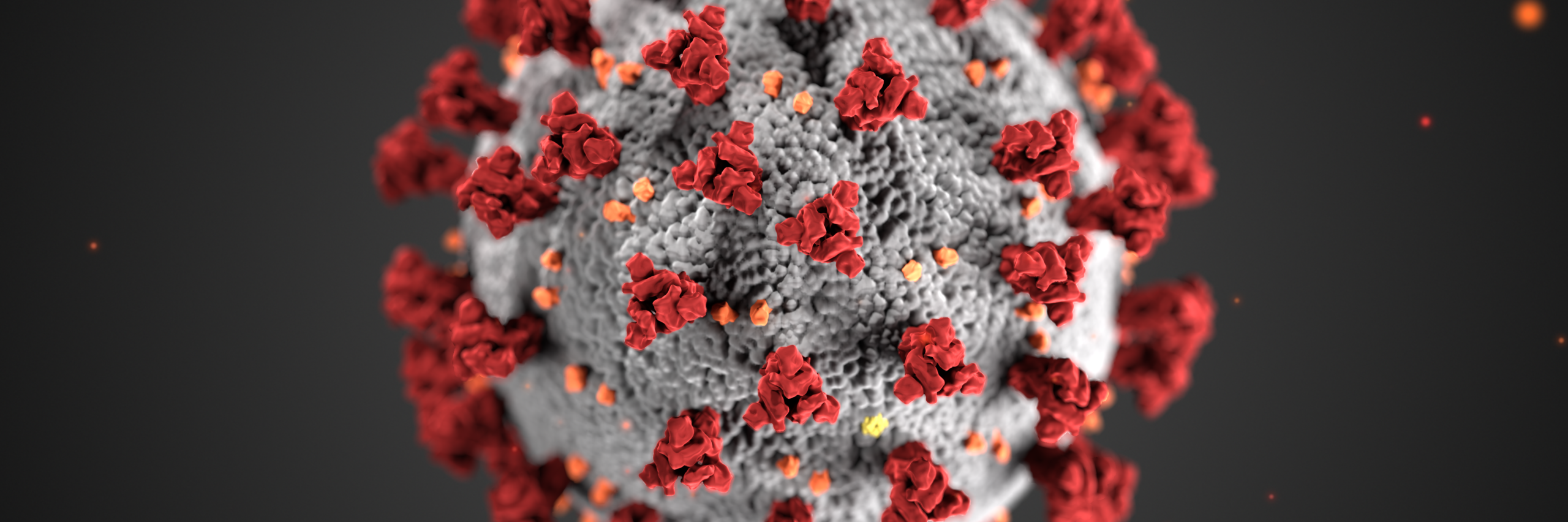

1 April 2020

Payment Holidays And Deferred Payments

As the COVID-19 pandemic escalates, many businesses and individuals are facing increased financial pressure. Naturally enough, they are being forced to ask their suppliers for time to pay on invoices. If you’re a supplier, are there any pitfalls to avoid if you agree to accept payment holidays and deferred payments from your customer?

Suppliers in many different sectors are seeing requests from customers and clients for time to pay. Retailers, service providers, private schools, professional service firms – the list is a long one.

If you are a supplier, it is important not to inadvertently make a new contract with your customer with deferred payment arrangements. You probably already have terms & conditions which allow you to pursue an outstanding debt after a certain period. They may also say that you can charge interest. While you will want to assist your customer in a very difficult and unprecedented situation, you wouldn’t want to vary the terms of your contract. It is safest to allow the customer time to pay on a non-binding basis. You should make clear that you are not waiving the right to demand immediate repayment in full under the existing terms.

There is a fine line between that situation and where you have in effect revised the contract, whether orally or in writing. The new terms might be that you have agreed not to sue on a particular invoice (in return for payment by instalments or payment by a certain date). That could mean you are unable to enforce payment if in fact it is not paid.

The Danger Of An Accidental Credit Agreement

There is a further problem if a new contract is formed by agreeing payment holidays and deferred payments. It could be termed a credit agreement by way of ‘financial accommodation’. If your customer is an individual (not a business) then the agreement will probably be a regulated credit agreement. It could come within the remit of the Financial Services and Markets Act 2000 (Regulated Activities) Order 2001. You would in effect be a ‘lender’ to your customer. Being a lender without being authorised is a criminal offence and the agreement could be unenforceable.

Fortunately, deferred payment schemes can usually be structured so that they are exempt from the 2001 Order. It is important to take advice on a particular situation.

Notes

To find out more about business contracts and agreement, click here.