5 May 2022

Planning Your Legacy Through Charitable Giving In Your Will

There are many reasons why someone might choose to leave money to charity in their will. Tax planning may be a key incentive, or it could be due to a lack of close family members. Some may simply wish to create a longer lasting personal legacy or they might have strong feelings about a certain cause.

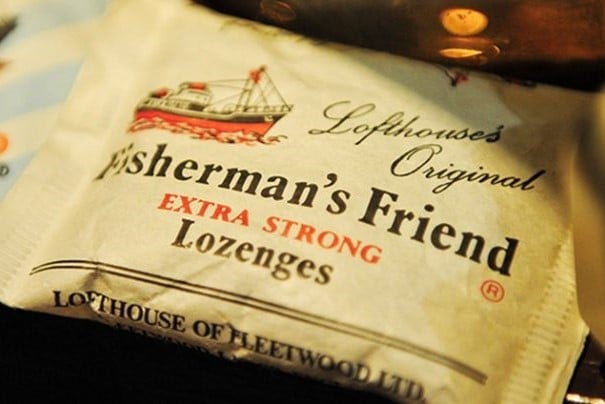

Last year, Fisherman’s Friend heiress Doreen Lofthouse hit the headlines when she left £41.4 million from her family’s fortune to the Lofthouse Foundation. She contributed generously to causes close to her heart throughout her lifetime and leaving such a significant sum on her death was designed to allow the foundation to continue her philanthropic work.

In this post we explore the key motivations for charitable legacies and highlight the benefits.

Charitable Gifts Are A Great Option For Those Without Close Family

Whilst Doreen Lofthouse did leave behind a son who has carried on her family legacy, sometimes someone might be the last living family member.

If you no longer have any close family or friends, you might not want your money to end up with distant relatives who you never speak to or see. If you find yourself in this situation, a gift to charity could have more meaning to you. Or perhaps, like Dorren Lofthouse, you may feel that your family is not in need of your entire estate and that you would prefer to leave a portion of it to causes you care about.

Making a will in which you clearly set out your wishes is the only way to ensure that any charities can benefit from your estate. If you die without a will then the ‘intestacy rules’ apply, and these never provide for money to pass to charity. If you leave no relatives, intestacy will mean all of your assets end up being left to the Crown. Most would prefer for their money to pass to a good cause of their choosing.

Creating A Lasting Personal Legacy With Charitable Gifts

Leaving any sum to charity under your will allows you to ensure that you are remembered for the causes that mean the most to you.

In Doreen Lofthouse’s case, her sizeable donation was made to allow the Lofthouse Foundation to use the funds for revitalising her hometown of Fleetwood in Lancashire. Having set up the foundation for this purpose in 1994, this was clearly a goal throughout her lifetime. Not only will the donation benefit those in the area, but locals have also called for a memorial to be erected in her honour to ensure her personal legacy will endure beyond the monetary gift.

Whilst not everyone who leaves money to charity ends up with a permanent memorial, charities are grateful for any sums they receive and your legacy will live on in the meaningful work they are able to provide as a result of your gift, whatever size it may be.

The Effect Of Charitable Giving On Inheritance Tax

For many, tax saving is not the key consideration for leaving sums to charity, but it is usually a welcome side effect.

Any gifts you leave to charity in your will pass free of inheritance tax, as charities count as exempt beneficiaries. This reduces the value of your estate by the amount of the gift before any tax-free allowances are taken into account, leaving a smaller pot to fall subject to inheritance tax.

In addition, if you leave 10% or more of your estate to charity the remainder benefits from a reduced inheritance tax rate, meaning a greater share for your other beneficiaries. Inheritance tax calculations and tax-planning is complex, and it is advisable to seek advice before finalising decisions on the basis of tax.

How Can We Help?

If you wish for some, or all, of your assets to pass to a charity close to your heart, the only way of ensuring this happens is to include clear instructions in your will. Making a will allows you to control how your estate passes when you die, including specifying charitable gifts, whilst making sure everything passes in the most tax efficient way.

Our solicitors can advise you on preparing a will in a way that ensures your choices are clear and legally binding, as well as helping you to create the legacy you wish to leave.

Notes

For more information about making a will click here.